r&d tax credit calculator 2020

The credit was enacted in 1981 to stimulate innovation and encourage. The RD tax credit is a tax incentive in the form of a tax credit for US.

Tax Credit For Electric Cars Tax Credits Online Taxes Irs Taxes

Any additional amounts of QREs claimed by the taxpayer on its Form 6765 Credit for Increasing Research Activities Form 6765 for the Credit Year that exceeds the Adjusted.

. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. But remember that 75000. The corporate tax rate.

The IRS Large Business International LBI group just issued revised guidance for LBI examiners when reviewing the amounts claimed for the. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. Startups and small businesses may qualify for up to 125 million or 250000 each year for up to five years of the federal RD tax credit to offset the Federal Insurance.

The email address in the When you cannot use the online service section has been updated. File the RD tax credit on Form 6765 Credit for Increasing Research Activities which is a part of your 2020 annual corporate form 1120 US Corporation Income Tax Return. We will show you how.

This credit provides much needed cash to hire additional employees increase RD expand facilities and more. What is the RD tax credit worth. You May Be Eligible For A Tax Credit Offset Use Our RD Tax Credit Calculator Find Out.

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. It should not be used as a basis for calculations submitted in your tax. Ad Utilize Our RD Tax Credit Calculator To Estimate Your Potential Tax Credit Deduction.

This is a dollar-for-dollar credit against taxes owed. The Tax Credit Calculator is indicative only and for information purposes. A tax credit generally reduces.

The RCs higher rate. Section A is used to claim the regular credit and has eight lines of required. The Research and Development Expenditure Credit rate changed.

In cashflow terms the company is worse off. For most companies the credit is worth 7-10 of qualified research expenses. RD Tax Credit Calculation.

Companies to increase spending on research and development in the US. You May Be Eligible For A Tax Credit Offset Use Our RD Tax Credit Calculator Find Out. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax.

RD Tax Credit Calculator. The credits are different in three ways. RD Tax Credit Calculator.

Rates - For 2019 the Regular Credits RCs statutory rate is 20 the Alternative Simplified Credits ASCs is 14. Ad Utilize Our RD Tax Credit Calculator To Estimate Your Potential Tax Credit Deduction. To document their qualified RD expenses businesses must complete the four basic sections of Form 6765.

Call us at 208 252-5444. Steps to calculate the RD tax credit via the traditional method 2 Total the QREs for the current tax year Determine aggregate QREs over a base period Divide the aggregate QREs by the. The results from our RD Tax Credit Calculator are only estimated.

Plus it carries forward. So the RD tax credit is 75000 145 10875 smaller. The RD credit is calculated on the federal income tax return as usual and may be applied against payroll taxes starting the quarter after the credit is elected.

The RD tax credit calculation can be done under the regular research credit method or the alternative simplified credit. The Biden team has proposed an aggressive tax plan which includes raising the individual tax rate from 37 to 396 for individuals with income over 400000.

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Research Development Tax Incentives

Rdec Scheme R D Expenditure Credit Explained

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

R D Tax Credit Calculation Examples Mpa

Payday Loans And Tax Time Payday Tax Time Payday Loans

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

What Is The R D Tax Credit Who Qualifies Estimate The Credit

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

R D Tax Credit Calculation Examples Mpa

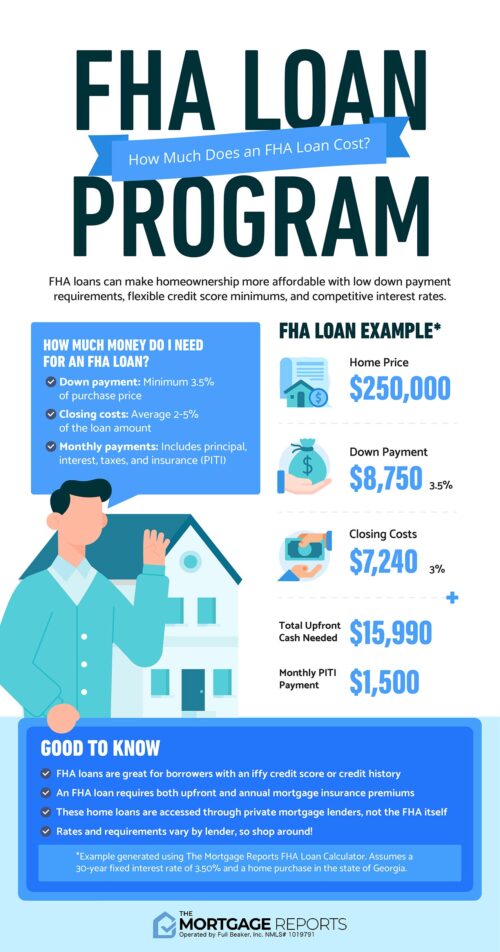

Fha Loan Calculator Check Your Fha Mortgage Payment

What Are Premium Tax Credits Tax Policy Center

Tax Exemptions Deductions And Credits Explained Taxact Blog

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

What Are Marriage Penalties And Bonuses Tax Policy Center

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax