rank real estate asset classes by risk

Some risks are shared by every investment in an asset class. Ad Access Real Estates Historically Consistent Return Potential With Fundrise.

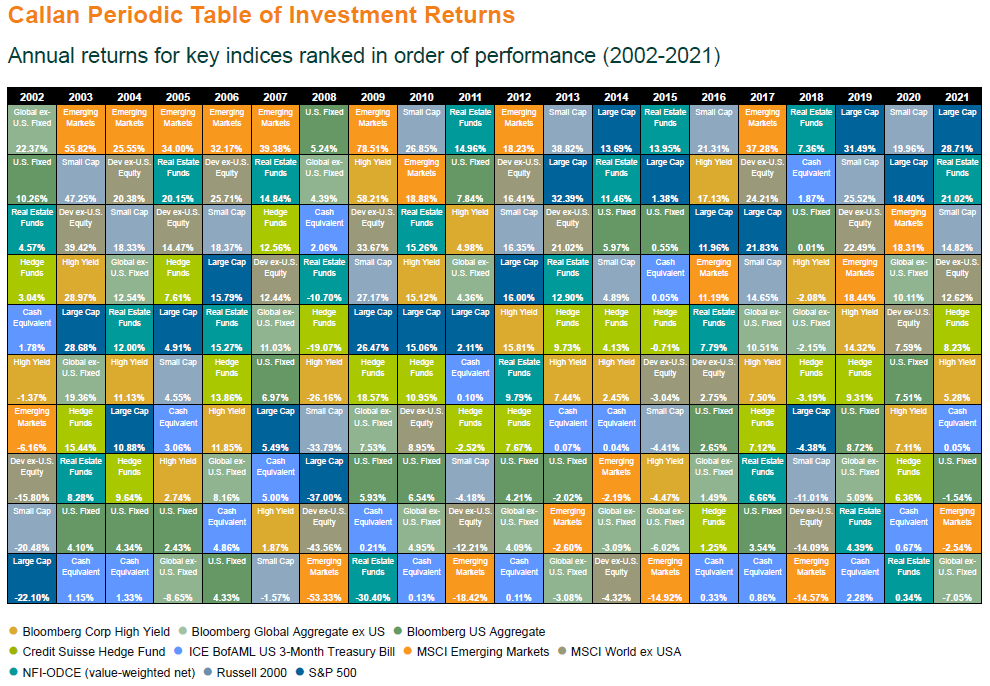

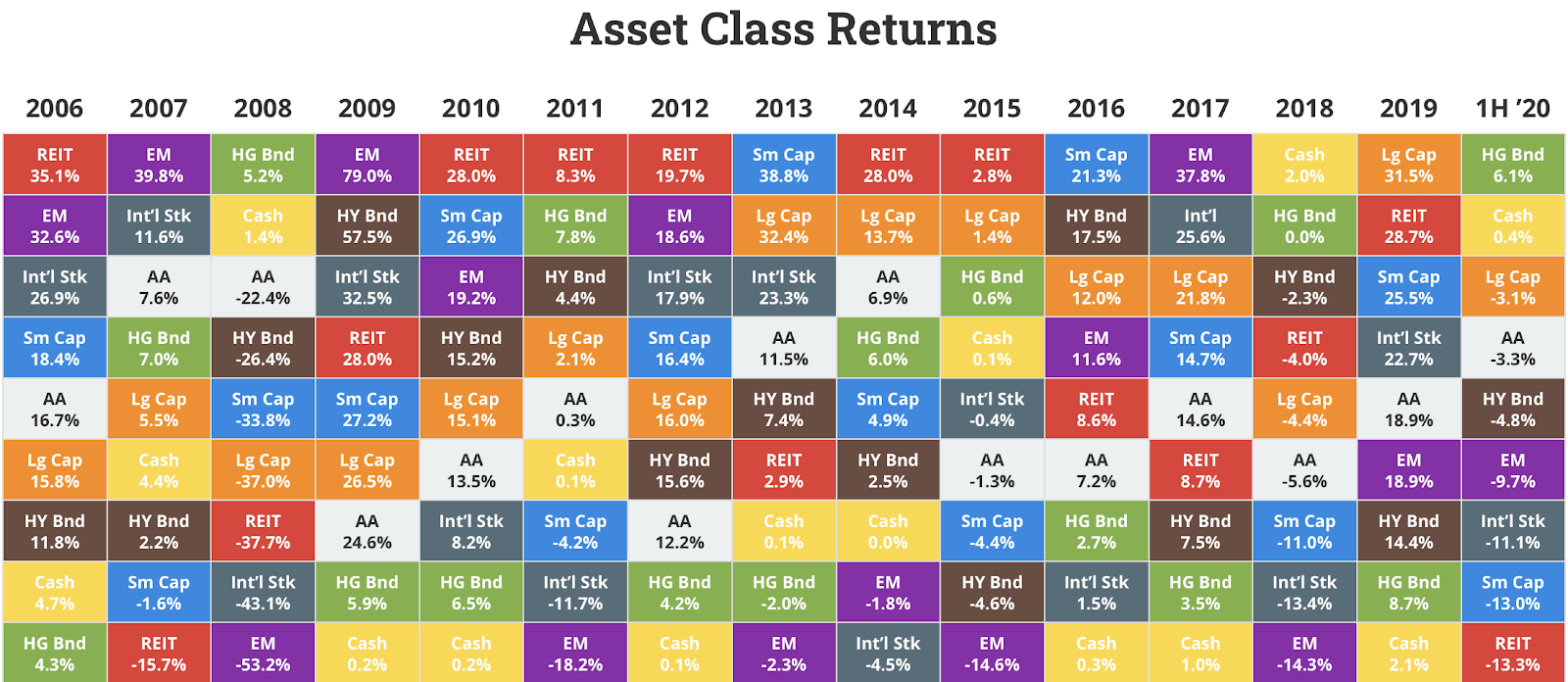

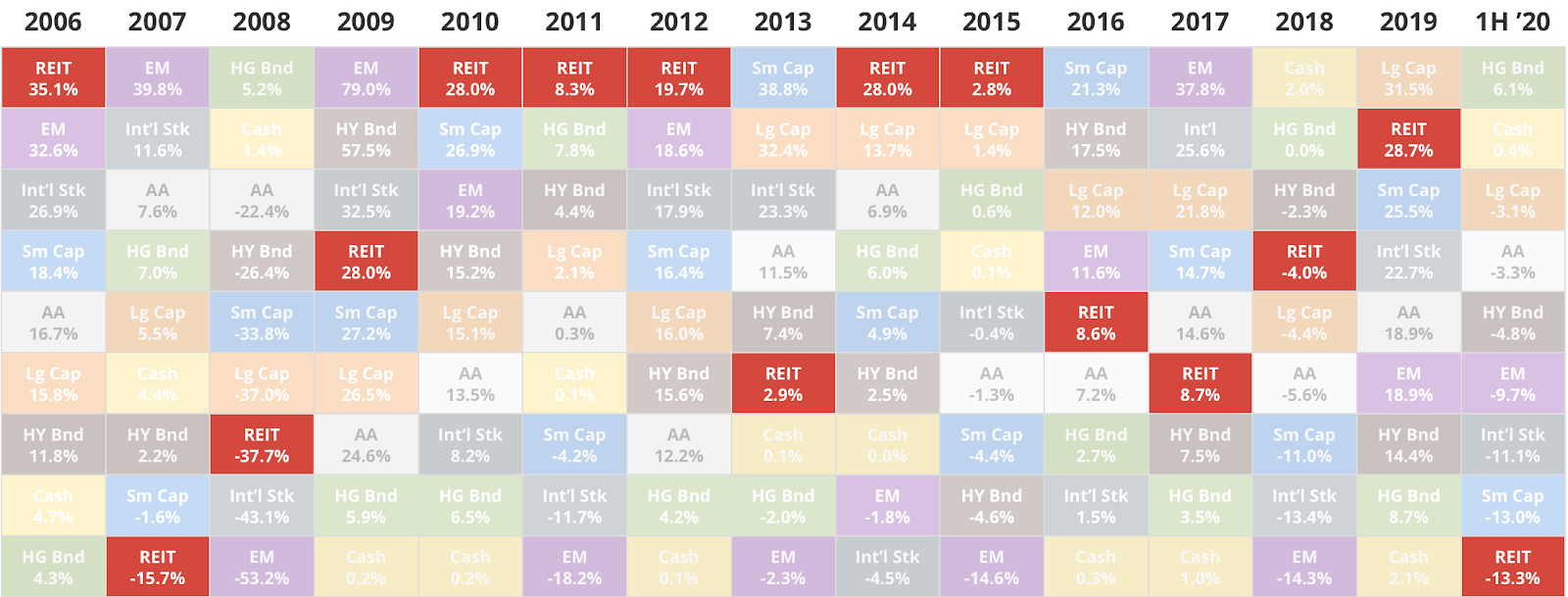

What History Can Teach Us About Asset Class Diversification In 4 Charts

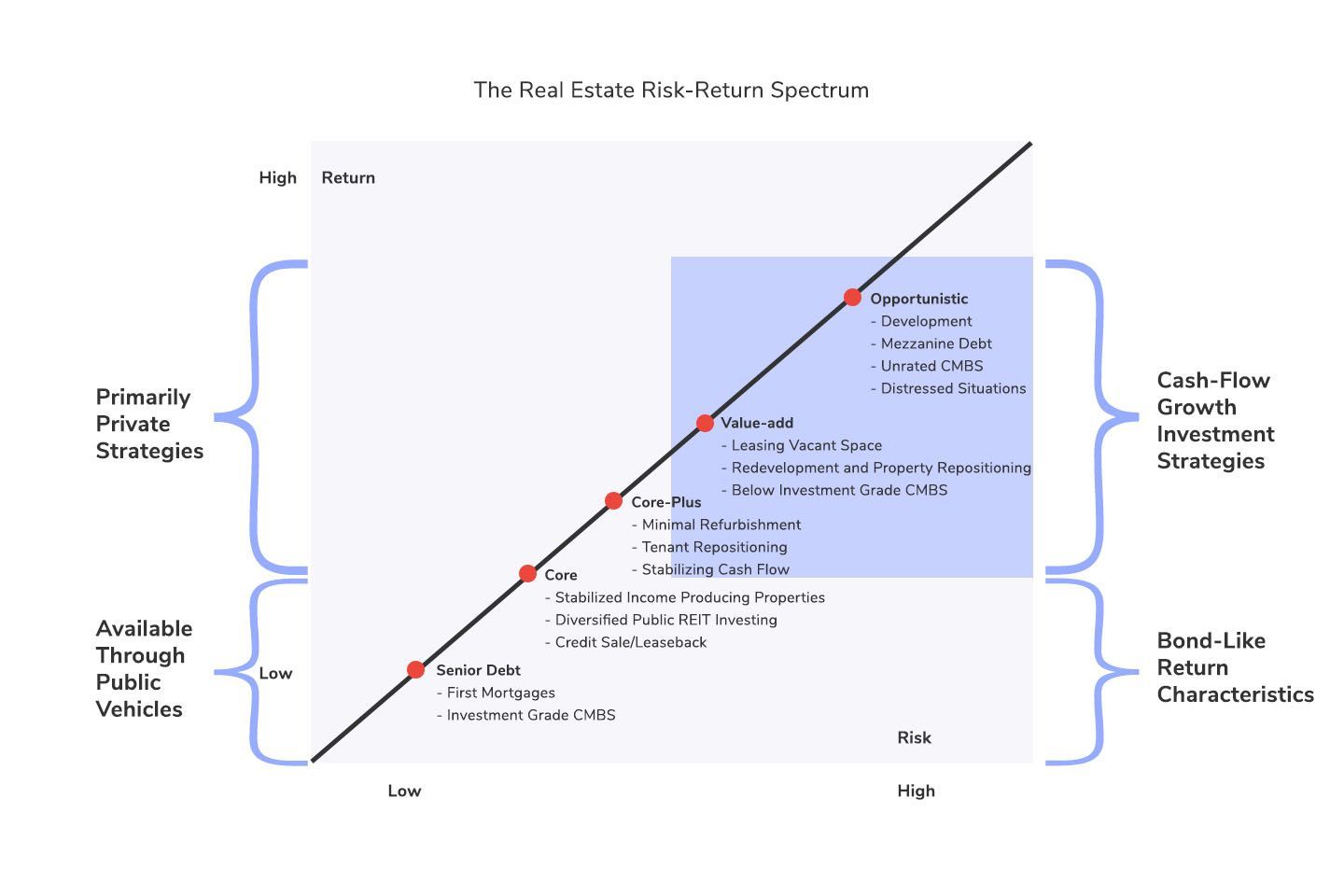

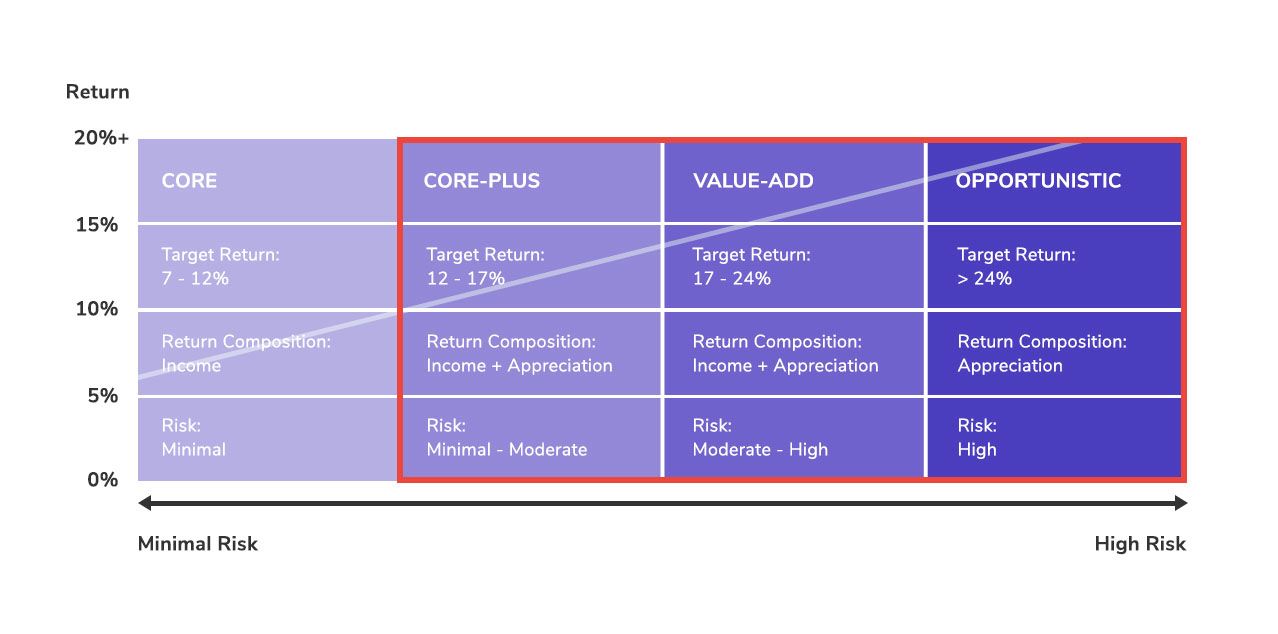

The sacred cow of real estate asset classes has consistently been core assets such as retail office and Class A multifamily.

. This levering up creates a riskreturn continuum by which we can assess risk-adjusted net-of-fee performance of non-core funds through the volatility of gross returns. Ad Our free guide may help you get the facts before taking the dive. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk.

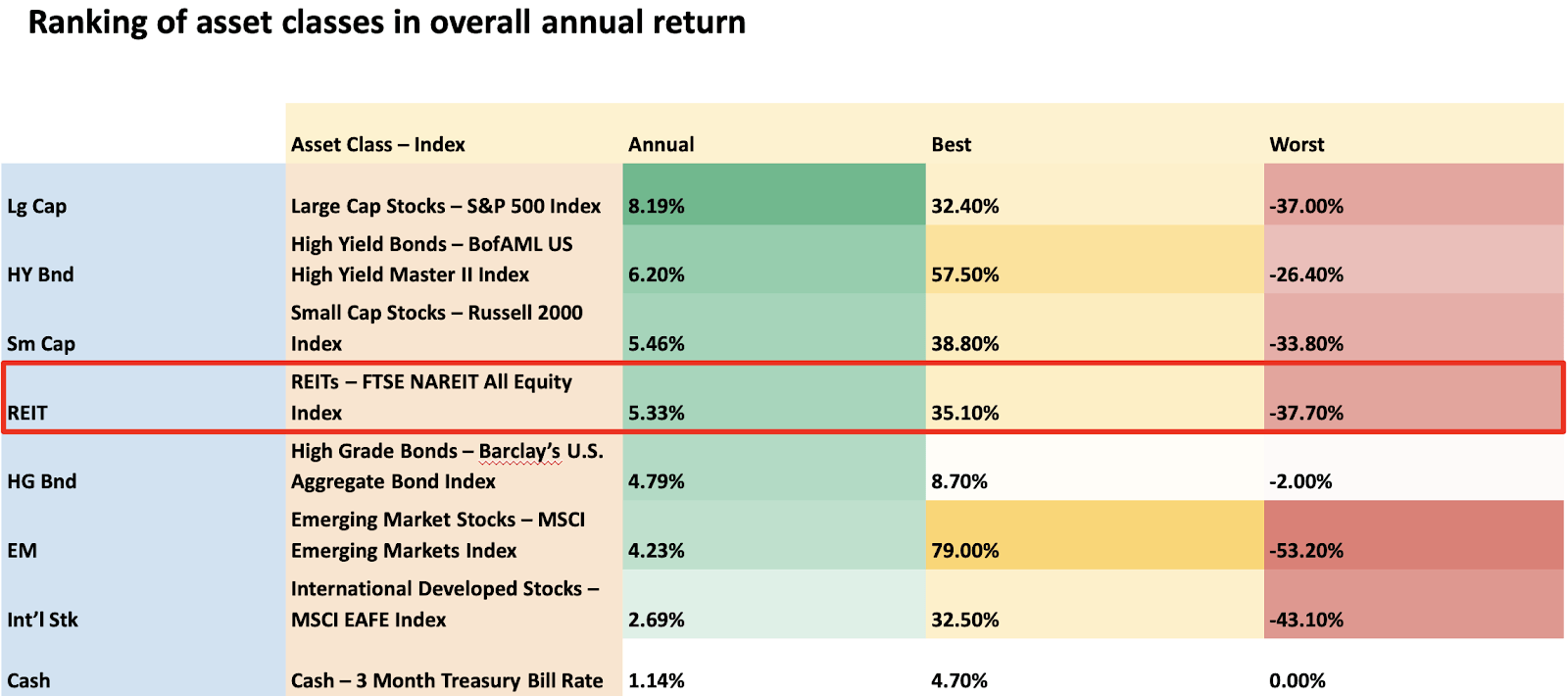

Ranking The Historical Returns of Asset Classes. Homes built in the last 20-30 years. Im mainly looking at.

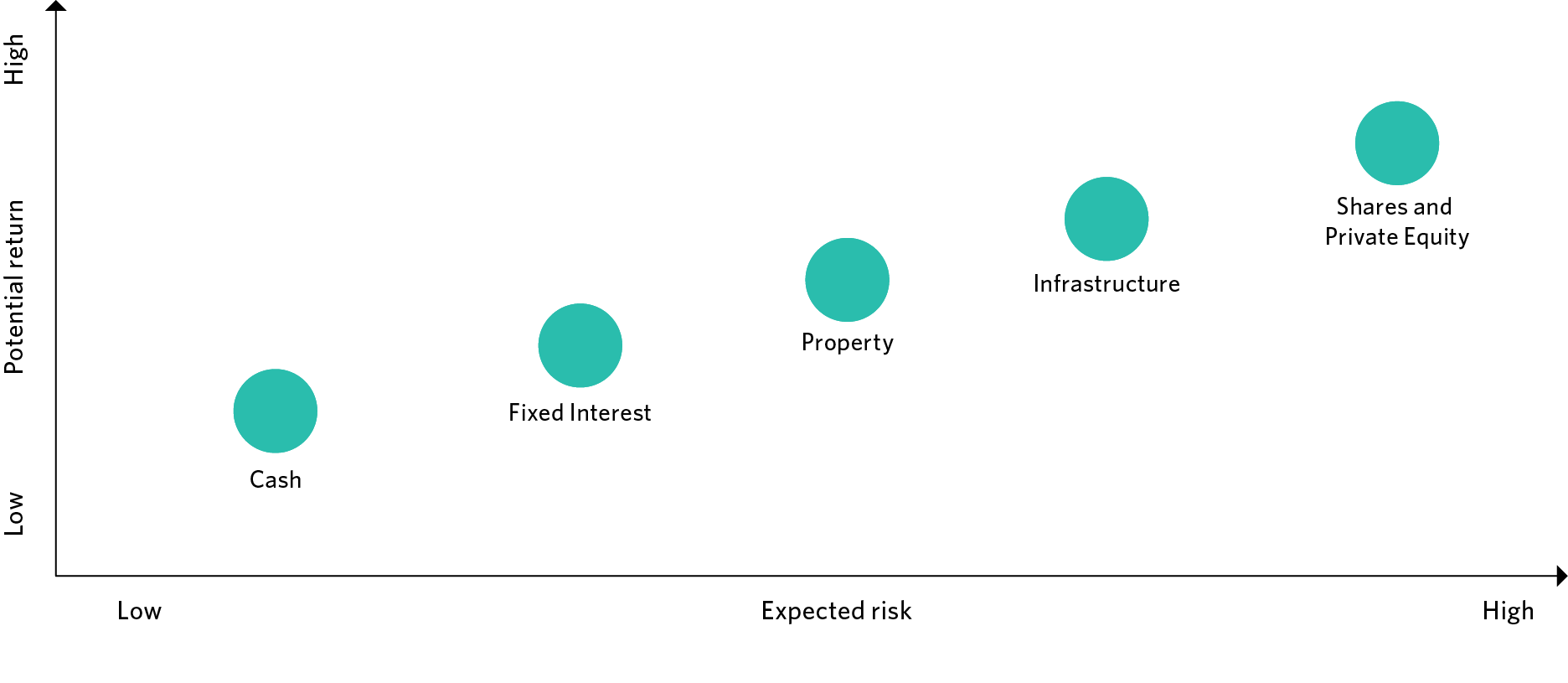

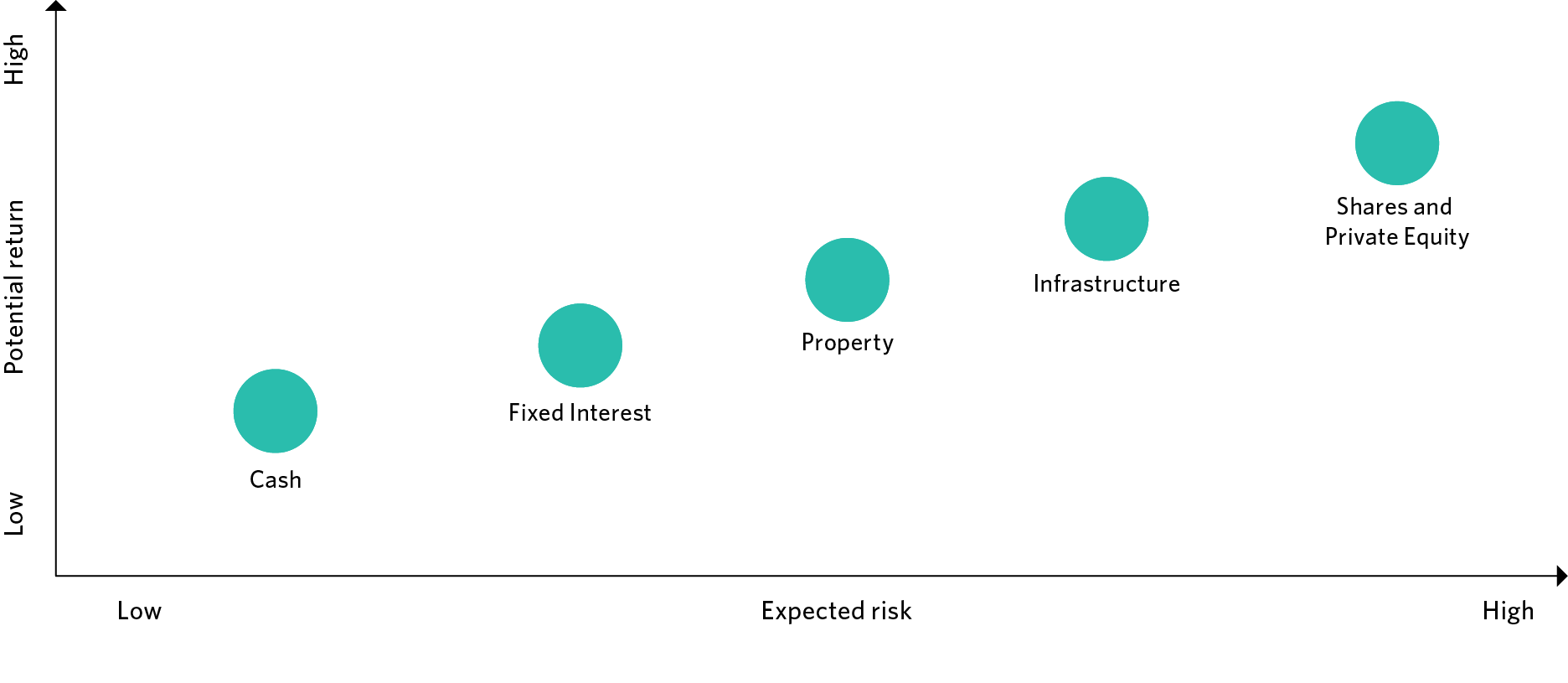

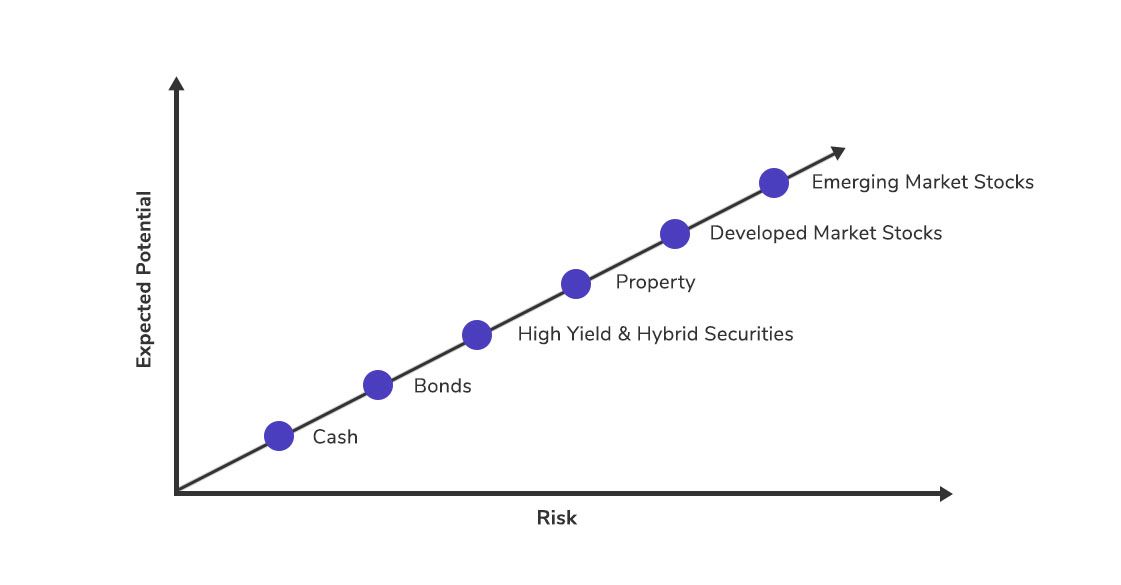

Core Core Plus Value-Add and Opportunistic are terms used to define the risk and return characteristics of a real estate investment. The Ranking Table shows a Preferred section a Neutral section and an Avoid section. As you can see in the chart above historically the amount return or earnings has increased as the risk associated with the.

500 of the largest US. But I find this definition to be too narrow. As an asset class real estate investments.

The familiar term for equities. Homes built in the last 10-20 years. Each asset class is unique regarding the related risk taxation ownership exchangeability.

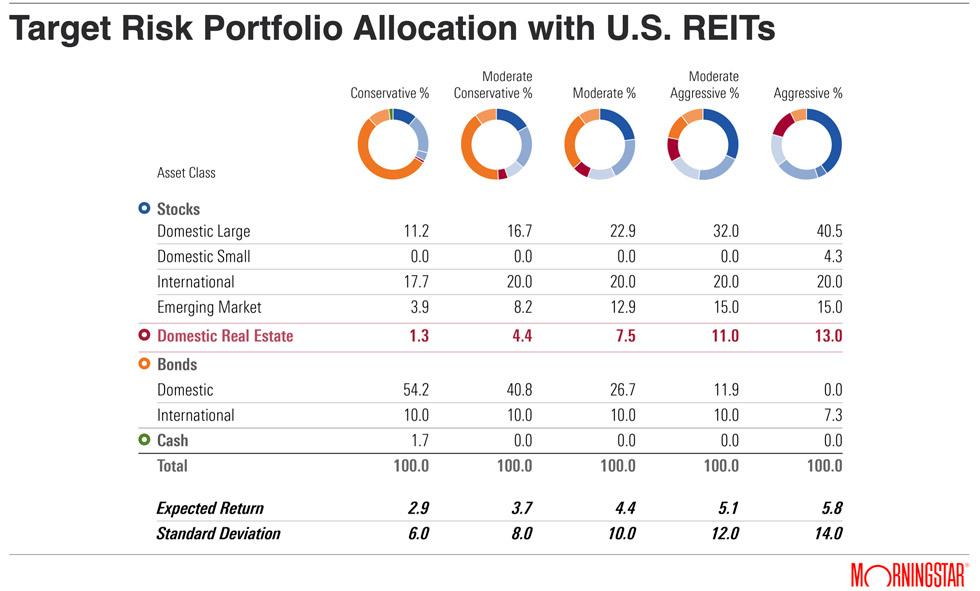

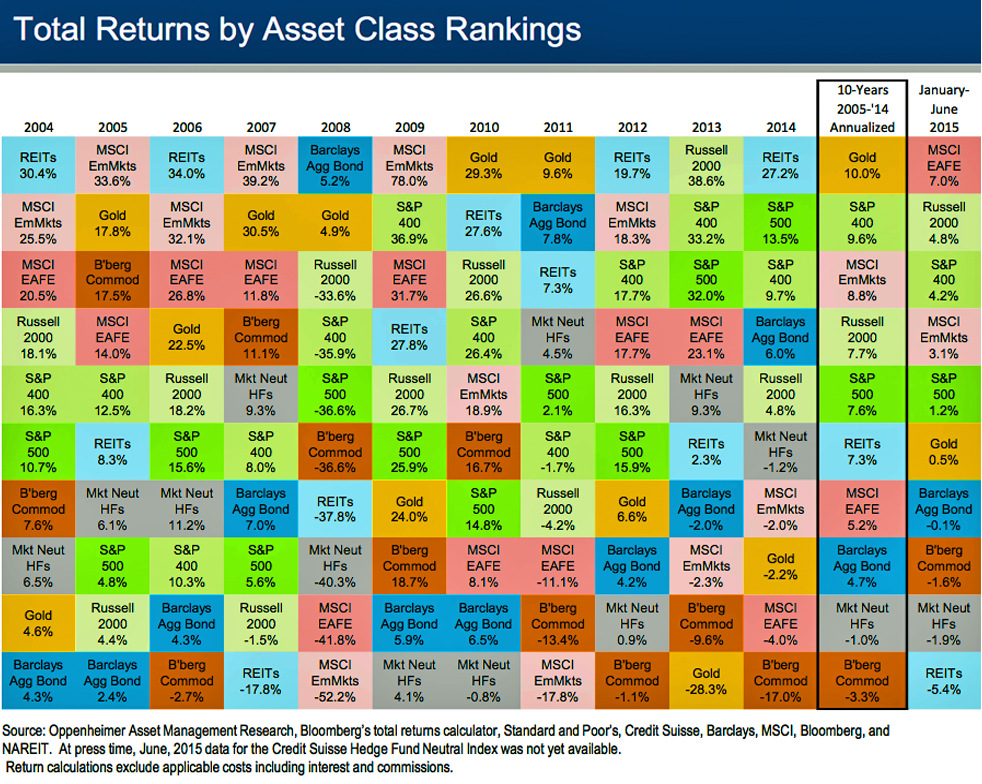

Meanwhile a majority of those who retire in their 50s and 60s expect to live much longer than 20 years and thus most consider inflation risks as much of a threat as stock. The NAREIT Index shows that the asset class has beaten out stocks bonds diversified portfolios commodities and cash. Global commodities saw the lowest return over the last 10 years.

Tax and other government regulations and other factors. High risk with high return to low risk with low return. The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US.

What is an Asset Class. Real estate experts and investors share different perceptions when it comes to ranking property and area classes. -Multifamily -Retail -Office -Student living -Light.

Real estate has the highest risk and the highest potential return. Most will rank them on a general scale from Class A to. Some examples of major asset classes include equities bonds money markets and real estate.

When investing some assets are considered safe while others are considered risky this includes savings accounts T-bills certificates of deposit equities and derivatives. Ranking the real estate asset classes in terms of risk. The first asset class is real estate.

Equities stocks and fixed income bonds are traditional asset class. For investors to take on higher risks they would need to be adequately compensated for the additional risks that they bear. The Preferred section is comprised of the 10 highest-ranked Asset Classes.

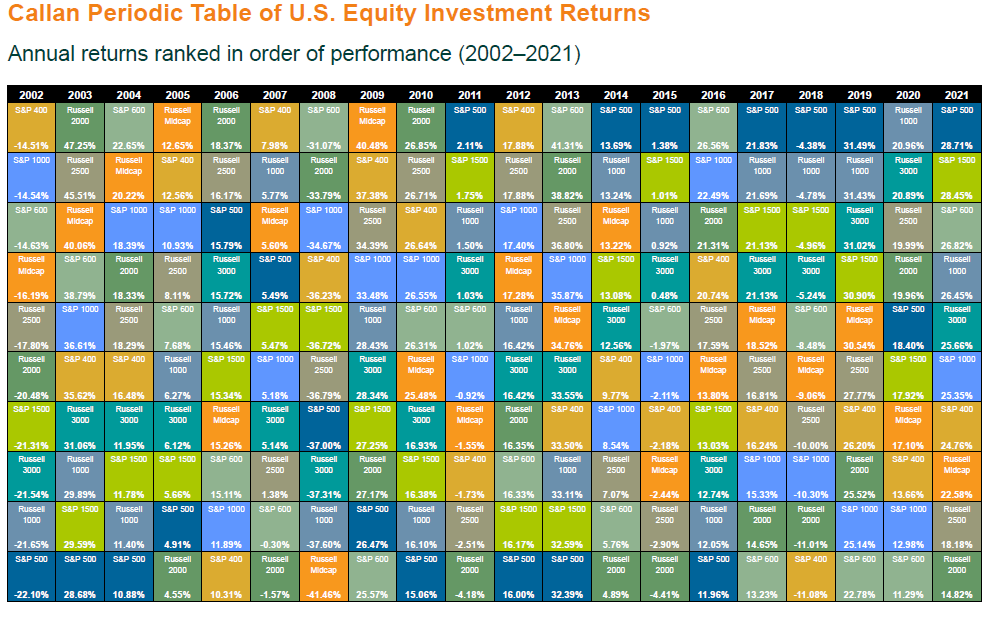

ASSET CLASS RISK CONSIDERATIONS. Oct 21 2016 235 PM EDT. In January of 2019 and 2020 I published year-in-review posts on the returns performance of various asset classes.

The SP 500 index. Commercial real estate offers two ways to diversify your investment portfolio. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of this information before making any decisions based on such.

However workforce multifamily has historically. Help Minimize Risk And Maximize Return Potential Simultaneously With Fundrise. The asset classes types include fixed income cash cash equivalents equity and real estate.

See the bottom of the graphic for the specific indexes used. Asset class is a group of assets with similar characteristics particularly in terms of risk return liquidity and regulations. An asset class is a group of similar investment vehicles.

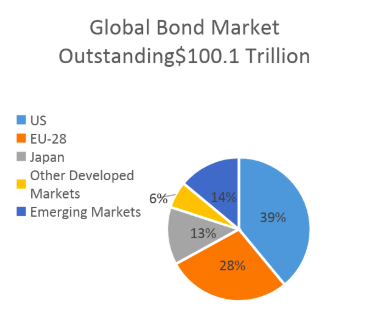

Asset class is a group of assets with similar characteristics. All investments involve risk. US and Global Bonds.

Relationship Between Risk and Return. Equities offer an ownership stake in a business. Asset Class Ticker Description of Holdings Risk Potential out of 5 US Large Cap Stocks.

Companies which span many. US and Global Real. One example would be Real Estate.

Homes built in the last 30 years. On the other hand real estate investment trusts REITs. Plummeting oil prices and an.

They range from conservative to. Different classes or types of investment assets such as fixed-income investments Fixed Income. First the return correlations of commercial real estate compared to other asset classes has.

New Morningstar Analysis Shows The Optimal Allocation To Reits Nareit

Asset Classes Explained Understanding Investments Unisuper

Know Your Real Estate Risk Reward Spectrum Before Investing

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

All About Asset Classes And Investment Diversification The Motley Fool

Commercial Real Estate Trends Toptal

Know Your Real Estate Risk Reward Spectrum Before Investing

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

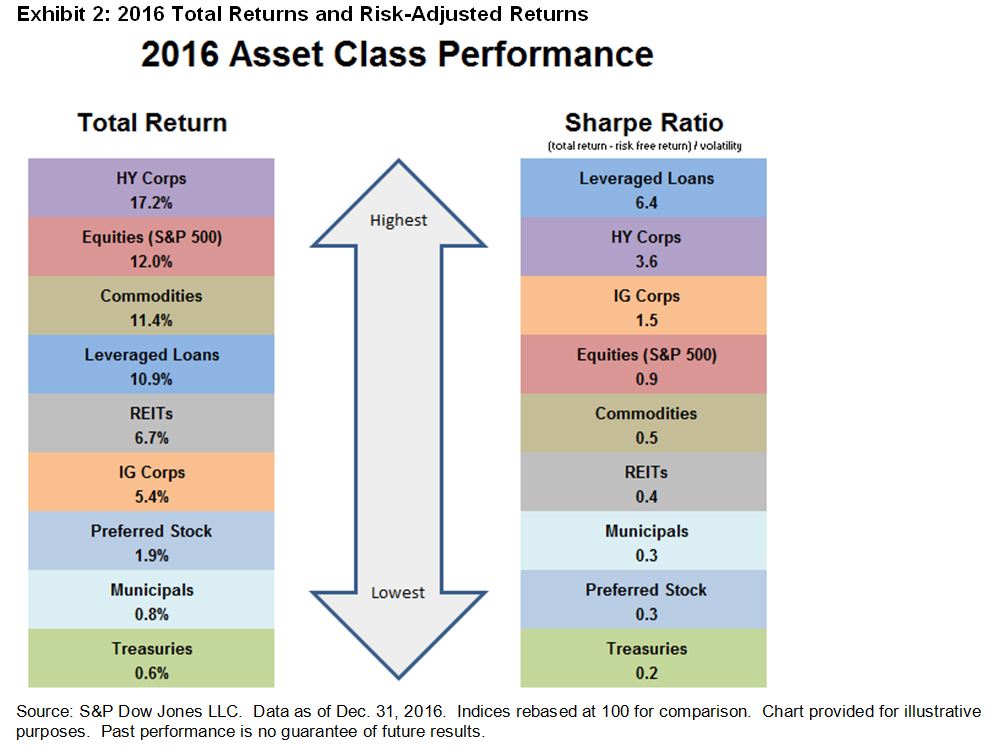

Year In Review 2016 Asset Class Performance Seeking Alpha

Chart The Historical Returns By Asset Class Over The Last Decade

Know Your Real Estate Risk Reward Spectrum Before Investing

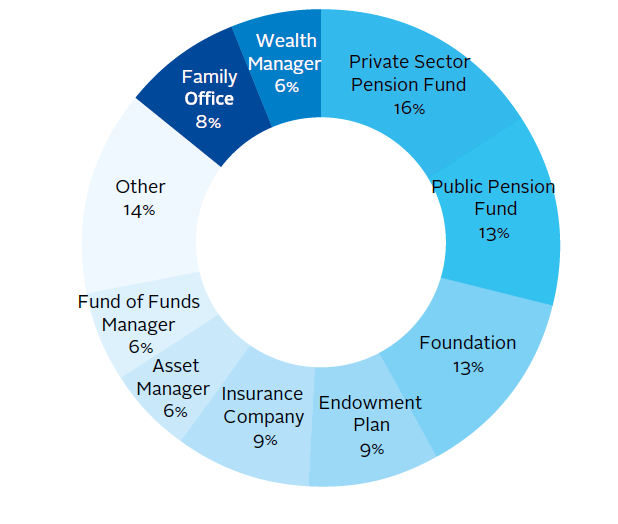

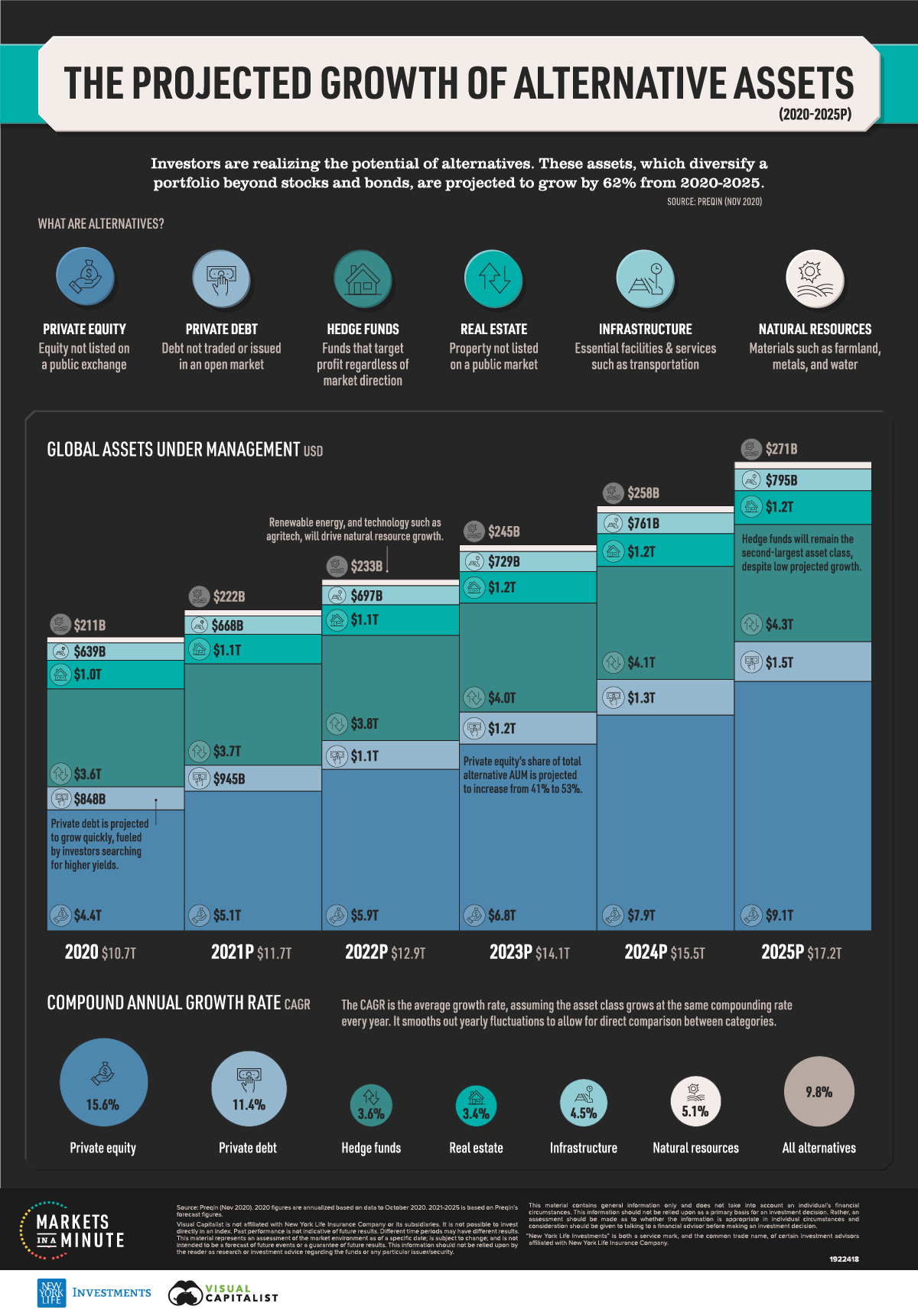

Alternative Assets How Much Will They Grow By 2025

What History Can Teach Us About Asset Class Diversification In 4 Charts

How Housing Became The World S Biggest Asset Class The Economist

Asset Class Definition Types Of Asset Classes Franklin Templeton