georgia ad valorem tax motorcycle

Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current. Of the Initial 80 fees collected for the issuance of these tags the fees shall be.

Georgia Bill Of Sale Form For Vehicles

As of 2018 residents in most Georgia counties pay a one.

. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit. Annual Special Tag Fee.

Andres Villegas of the Georgia Forestry Association said timber. Do I have to pay the Georgia ad valorem tax on a leased vehicle. Motorcycles may be subject to the following fees for registration and renewals.

The Ad Valorem Tax or the Property Tax is based on value. 2021 Property Tax Bills Sent Out Cobb County. 80 plus applicable ad valorem tax.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and. As of 2018 residents in most Georgia counties pay a one. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

Under current state law family-owned farms are exempt from ad valorem tax on a lot of their equipment. This calculator can estimate the tax due when you buy a vehicle. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Ad Valorem Tax Required. According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes.

Jan 14 2015 1. 5500 plus applicable ad valorem tax. Cost to renew annually.

For the answer to this question we consulted the Georgia Department of Revenue. 393 Type of Motorcycle Currently Riding. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015.

For tax year 2018 Georgias TAVT rate is 7 prtvrny. Registration Fees Taxes.

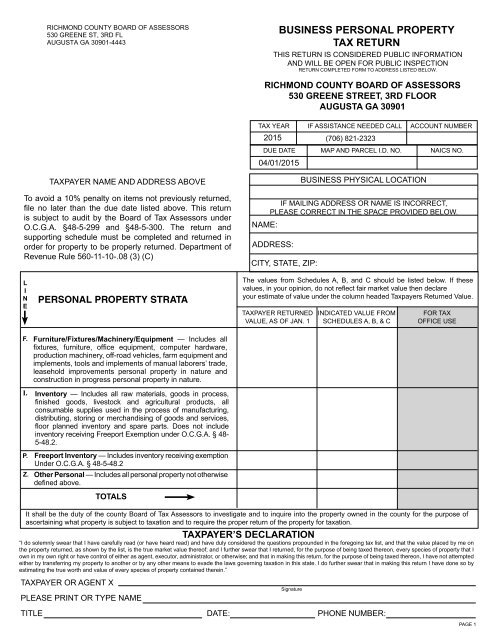

Georgia Department Of Revenue Caveat 2010 Mav For Personal Property Expanded Freeport Inventory Elimination Of Ad Valorem Tax On Business Inventory Heavy Ppt Download

Tax Commissioner S Office Cherokee County Georgia

2021 Property Tax Bills Sent Out Cobb County Georgia

Tangible Personal Property State Tangible Personal Property Taxes

Car Tax By State Usa Manual Car Sales Tax Calculator

Motor Vehicle Richmond County Tax Commissioners Ga

Motor Vehicle Division Georgia Department Of Revenue

Business Personal Property Tax Return Augusta Georgia

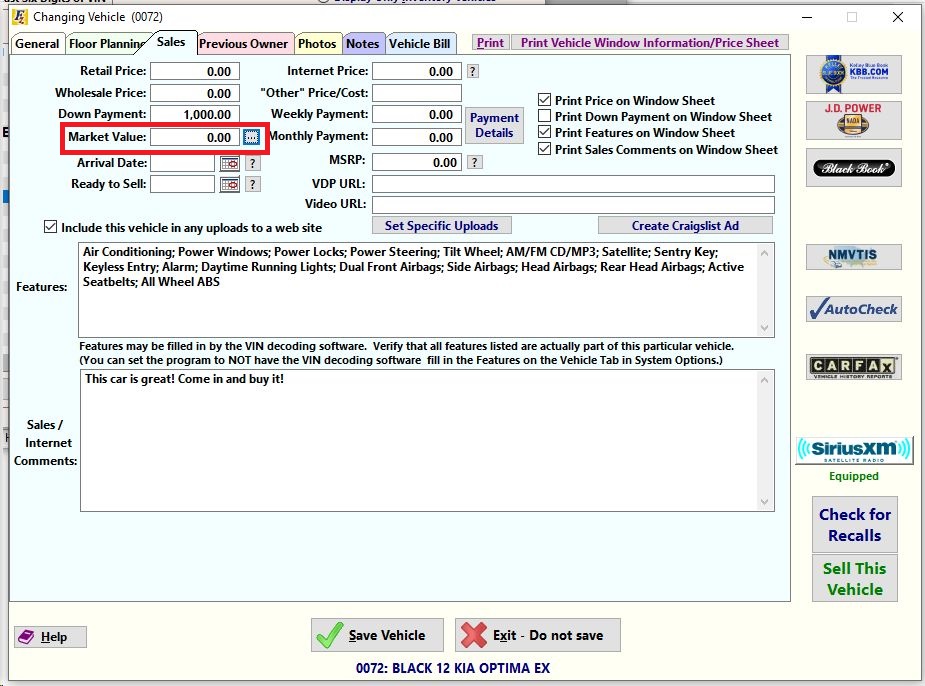

Frazer Software For The Used Car Dealer State Specific Information Georgia

Cherokee County Ga Motor Vehicles

Tax Commissioner S Office Cherokee County Georgia

Georgia Bill Of Sale Form For Vehicles

Georgia Title Ad Valorem Tax Fee Informational Bulletin Mvd 2013

Georgia Title Ad Valorem Tax Updated Youtube

Moving To Georgia Just Bought A Car And Worried About Double Tax Quick Title Ad Valorem Tax Tavt Money Saving Break Down R Atlanta